All Categories

Featured

Table of Contents

- – Employee Benefits Consulting Firms Buena Park, CA

- – Harmony SoCal Insurance Services

- – Employee Benefits Consultants Buena Park, CA

- – Key Man Disability Insurance Buena Park, CA

- – Payroll And Services Buena Park, CA

- – Key Man Disability Insurance Buena Park, CA

- – Key Man Disability Insurance Buena Park, CA

- – Payroll Service For Small Businesses Buena P...

- – Employee Benefits Management Solutions Buena...

- – Payroll Services For Small Businesses Buena ...

- – Employee Benefits Company Buena Park, CA

- – Employee Benefits Consulting Buena Park, CA

- – Employee Benefits Consulting Firms Buena Par...

- – Employee Benefits Brokerage Firms Buena Park...

- – Harmony SoCal Insurance Services

Employee Benefits Consulting Firms Buena Park, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

Other crucial points are safety and security functions and compatibility with time monitoring and audit devices. You understand your company best and can assess when relying on outdoors person or device is the ideal action for you. A leading advantage to working with a payroll options company, like PayTech, is having a devoted account manager.

This point of contact can also provide ideas on exactly how to use the current modern technology for also quicker results. A tool or program alone can't provide you this. It is essential to understand that it is difficult to have a one-size cost covering for pay-roll services. Every company has various demands from a payroll provider.

Various other pay-roll business for tiny businesses have various prices rates and are subject to various other contingencies that differ. Pay-roll can be made easier by contracting out HR tasks.

When a small company spends in payroll software application and finishes the configuration, the procedures become quicker and more efficient. The software application pays for itself as time advances.

Employee Benefits Consultants Buena Park, CA

Paytech offers this beginning at $51 monthly, and it is consisted of in the same plan with direct down payment over. Various other firms have different rates plans based on labor force dimension, the technology needed, and extra. Companies thrive off of pay-roll. Without it, services would crumble. Take benefit of the most current modern technology readily available with Paytech's pay-roll options for small companies.

A smart person when stated, "Outsource your payroll." We don't recognize that specifically that sensible individual was, yet here at FA Bean Counters, our team believe that utilizing a payroll service is a really smart relocation. Payroll services are extremely prominent with today's company owners, and for great reason. Buena Park Payroll Service Small Business. They make the pay-roll procedure efficient and simple.

We use direct down payment and mobile pay-roll solutions that integrate with time and attendance monitoring. We additionally immediately compute deductions for taxes and retired life payments, and provide experienced support to assist make certain you remain compliant with all relevant regulations and policies. ADP helps companies manage payroll taxes by automating deductions from worker earnings and seeing to it the appropriate quantity of cash is provided to the government, based on the most current pay-roll tax obligation guidelines and policies.

Key Man Disability Insurance Buena Park, CA

In fact, it's exceptionally very easy to start with an on the internet pay-roll solution and add solutions such as time and attendance, HUMAN RESOURCES, insurance policy, retirement and more as you need them. ADP mobile options provide workers accessibility to their pay-roll information and advantages, despite where they are. Staff members can complete a variety of jobs, such as view their pay stubs, manage their time and participation, and go into time-off demands.

This process can be time consuming and error vulnerable without the correct resources. That's why many companies transform to payroll company for automated options and compliance knowledge. Employers typically aren't needed to withhold tax obligations from repayments to independent specialists, which simplifies pay-roll processing. Nevertheless, a pay-roll solution might still serve.

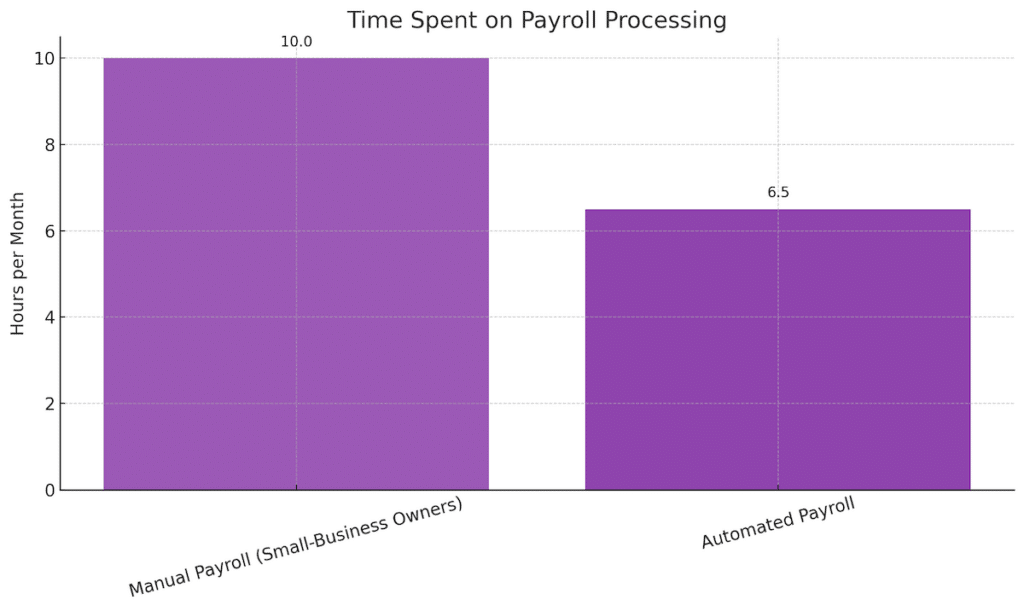

Handling pay-roll in several states calls for monitoring, understanding and following the tax obligation laws and laws in all states where you have workers. You might additionally require to register your company in those states even if you do not have a physical location. Find out more about multi-state compliance If you're doing pay-roll by hand now and strategy to change to a payroll service company, you ought to expect to reduce the moment you commit to the process.

ADP uses payroll solutions for companies of all dimensions tiny, midsized and huge. We also accommodate many industries, consisting of construction, manufacturing, retail, medical care and even more. ADP's pay-roll services are automated, making it very easy for you to run pay-roll. Below are several of the crucial actions to the procedure that we'll take care of for you behind the scenes: The complete hours worked by workers is increased by their pay prices.

Payroll And Services Buena Park, CA

The software program has actually worked flawlessly, it saves me hundreds of dollars, and is actually easy to utilize. I recommend to every person. It is truly a solution worth spending for, you just don't need to.

In this article, we'll cover the top five remedies so you can get back to the enthusiasm that began your business and leave the payroll headaches behind. When choosing the ideal pay-roll company for extremely little organizations, it is critical to partner with a service provider that understands conformity constantly comes.

These features might consist of straight down payment, overtime estimations, benefits combinations, or organizing. Even though you're a very tiny company, contrast prices and charges across configuration expenses, monthly charges, and per-employee prices to locate a budget-friendly alternative that fits your spending plan.

Secret advantages of our payroll software application include our easy to use system (which makes handling payroll easy without needing expert-level expertise), which is backed by our industry-known specialized client service. Throughout service hours, you'll never get our voicemail or a chatbot.

Key Man Disability Insurance Buena Park, CA

: "ConnectPay has actually provided me with excellent solution for practically 10 years! Paychex Flex is a great choice if you're looking for a sophisticated pay-roll option that offers extensive information and visualizations.

In addition to basic payroll services, Paychex Flex systematizes Person Resources and supplies robust tax obligation tools with automated calculations. It's likewise compatible with over 350 incorporated services, like bookkeeping, benefits supervisors, and time trackers. Rates is available on a per-case basis, so reach out to their team to find out more.

It offers versatile strategies that allow you to either run pay-roll alone (or select even more comprehensive plans that consist of human resources services). Gusto excels at tax registration, making it a terrific fit for companies with remote staff members in the United States. It additionally uses support for international specialist settlements, which is ideal if your business contracts out a lot of job overseas.

Key Man Disability Insurance Buena Park, CA

Small company payroll usually leads to a huge headache as supervisors and owners find out just how to do pay-roll by hand. There are a great deal of aspects on the government and state degree you need to bear in mind to prepare payroll for both hourly pay-roll and employed staff members every pay duration. With the Homebase pay-roll app, your payroll computations are automated.

1 ERTC Added fees may use. 2 Paychex Assurance will certainly be provided for free to entrepreneur for the first three months of solution, and afterwards will certainly be supplied as a full collection of services for a repaired, all-encompassing fee. Program and/or any of the services used as component of Program go through eligibility and are void where limited by regulation.

WHAT THIS INDICATES FOR YOU: When you open a Card Account, we will request for your name, address, date of birth, and your federal government ID number. We might additionally ask to see your vehicle driver's permit or other recognizing info. Card activation and identity confirmation called for prior to you can use the Card Account.

Payroll Service For Small Businesses Buena Park, CA

Restrictions consist of: no international deals, account-to-account transfers and added lots. Usage of Card Account also subject to scams avoidance restrictions at any type of time, with or without notice.

Certain items and services may be certified under united state Patent Nos. 6,000,608 and 6,189,787. Use of the Card Account undergoes activation, ID confirmation and funds availability. Deal fees, terms, and conditions apply to the use and reloading of the Card Account. See the Cardholder Agreement for details. Mastercard is a signed up hallmark, and the circles style is a trademark of Mastercard International Incorporated.

Whether you're a start-up or an enterprise-level organization, efficient payroll software application is crucial. It isn't always economical to hire an in-house team to handle pay-roll, specifically for companies with a little headcount. Registering for a professional pay-roll process not just ensures that you pay staff members accurately and on schedule, however also enables your service to stay certified with an ever-changing tax code.

In this blog, we're mosting likely to explore the important aspects to take into consideration when picking a pay-roll software program and checklist the ten finest payroll software for little services' needs. Buena Park Payroll Service Small Business. Local business have specific payroll requires many thanks to obstacles such as expanding head count, limited sources, and an absence of inner payroll know-how

Employee Benefits Management Solutions Buena Park, CA

Factors to think about when selecting a payroll software consist of headcount, budget plan, and tax obligation compliance. Payroll software program should not add more time to jobs like invoicing, payroll records, or advantages administration. Seek a straightforward interface that improves common payroll services, in enhancement to self-service capabilities for onboarding and consumer assistance. Not every payroll provider is alike in regards to prices.

The lack of transparency over prices is an usual review of ADP, in addition to core pay-roll features such as staff member benefits monitoring just being offered as attachments. It obtains appreciation for ease of usage and personalized pay-roll records. Established in 1971, Paychex is a trusted name in the payroll and HR area.

Payroll Services For Small Businesses Buena Park, CA

With 3 prices strategies, it's simple for company owners to locate the best payroll service for their requirements. All strategies automate the pay-roll process and tax obligation declaring solutions for employee and service provider settlements, as well as worker self-service for accessibility to tax types and pay stubs. The Essentials intend starts at $39 each month, adhered to by $44 each month for Select and $89 each month for Pro.

Introduced in 2012 as ZenPayroll, Gusto's automatic pay-roll service currently serves more than 300,000 services.

QuickBooks Pay-roll additionally companions with SimplyInsured to supply health insurance policy benefits. All plans have a base charge for accounting functions, with the payroll attribute readily available for an added price. QuickBooks uses among the least expensive pay-roll intend on the marketplace at $15 monthly, which includes fundamental features consisting of tax obligation reductions and general coverage.

Employee Benefits Company Buena Park, CA

Wave Pay-roll is a cloud-based, small company pay-roll supplier supplied by Wave Financial Inc. Wave offers among the most basic methods for local business to file pay-roll tax obligations and manage employee's compensation. Unlike the packed plans used by the majority of small company payroll suppliers, Wave supplies prepare for specific solutions, consisting of bookkeeping and payment processing in addition to pay-roll.

Key attributes include three-day straight deposit, time tracking, a self-service site, and a complimentary pay-roll test. Wave doesn't provide computerized pay-roll in all 50 states. SurePayroll was established in 2000 and became a subsidiary of Paychex, Inc. in 2011. It offers an alternative to Paychex Flex for services that need a full-service service with HR features.

The benefits of Patriot consist of no lasting agreements and endless payroll runs. The easy prices structure makes it a solid alternative for companies with few staff members. Patriot obtains high evaluations for its user-friendliness and client support. Companies have a selection of two pay-roll strategies; The Basic strategy is $17 per month (+ $4 each) and covers basic organization demands such as two-day direct down payment, as well as a combination with QuickBooks Online.

Employee Benefits Consulting Buena Park, CA

The complete plan likewise guarantees tax filing accuracy, providing organizations one more layer of security. A downside is that Patriot doesn't provide any Human resources and advantages services. OnPay is a cloud-based pay-roll and HR solution established in 2007. OnPay uses one of the simplest pay-roll processes on the marketplace, with a single strategy selling at $40 monthly + $6 per individual.

The Zenefits payroll software program is a thorough strategy that includes unlimited pay runs, several pay timetables, and advantages reductions. Pricing by headcount makes Zenefits really versatile for businesses, as it isn't possible to outgrow your plan. At present, there is no choice to simply subscribe to the payroll feature.

Employee Benefits Consulting Firms Buena Park, CA

Pay-roll software program may not be the most interesting topic, yet it is vital for any type of business with staff members. By choosing a payroll solution provider that aligns with crucial business needs and objectives, you can transform away from tax files and spreadsheets and rather concentrate on expanding your business. An additional way to streamline and conserve time, energy, and cash in your service is to guarantee you are obtaining the ideal charge card processing prices for your organization demands.

Not every pay-roll service uses the exact same prices framework. A full-service pay-roll system may cost even more, but it could be excessive for several little companies.

A great pay-roll option uses automatic tax estimations for all levels of tax obligations and remains updated with law changes. It is useful to choose for a payroll provider that also consists of year-end tax obligation declaring solutions.

Employee Benefits Brokerage Firms Buena Park, CA

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

Small businesses can then focus extra on growth and much less on management jobs. Eric Simmons is a growth advertising and marketing and need generation experienced offering as the Senior Director of Development Advertising at Stax. During his period below, Eric has actually contributed in pushing the business's impressive development, leveraging his competence to accomplish significant milestones over the past 6 years.

Employee Benefits Brokerage Firms Buena Park, CAKey Man Disability Insurance Buena Park, CA

Payroll Service Providers Buena Park, CA

Close To Seo For Small Business Buena Park, CA

Companies Near Me Seo Consultant Buena Park, CA

Payroll Service Small Business Buena Park, CA

Harmony SoCal Insurance Services

Table of Contents

- – Employee Benefits Consulting Firms Buena Park, CA

- – Harmony SoCal Insurance Services

- – Employee Benefits Consultants Buena Park, CA

- – Key Man Disability Insurance Buena Park, CA

- – Payroll And Services Buena Park, CA

- – Key Man Disability Insurance Buena Park, CA

- – Key Man Disability Insurance Buena Park, CA

- – Payroll Service For Small Businesses Buena P...

- – Employee Benefits Management Solutions Buena...

- – Payroll Services For Small Businesses Buena ...

- – Employee Benefits Company Buena Park, CA

- – Employee Benefits Consulting Buena Park, CA

- – Employee Benefits Consulting Firms Buena Par...

- – Employee Benefits Brokerage Firms Buena Park...

- – Harmony SoCal Insurance Services

Latest Posts

Plumbing Emergency Service Near Me Rancho Santa Fe

Local Plumbers Miramar

Costa Mesa Family Portraits Photography

More

Latest Posts

Plumbing Emergency Service Near Me Rancho Santa Fe

Local Plumbers Miramar

Costa Mesa Family Portraits Photography