All Categories

Featured

Table of Contents

- – Affordable Life Insurance Plans Westminster, CA

- – Harmony SoCal Insurance Services

- – Life Insurance Term Plan Westminster, CA

- – Health Insurance Plans Near Me Westminster, CA

- – Estate Planning With Life Insurance Westminst...

- – Health Insurance Plans Company Westminster, CA

- – Best Individual Health Insurance Plans Westm...

- – Health Insurance Plans Company Westminster, CA

- – Family Health Insurance Plan Westminster, CA

- – Health Insurance Plans For Family Westminste...

- – Family Plan Life Insurance Westminster, CA

- – Health Insurance Plans Individuals Westminst...

- – Best Health Insurance Plans Near Me Westmins...

- – Estate Planning Life Insurance Westminster, CA

- – Children's Life Insurance Plans Westminster, CA

- – Health Insurance Plans Company Westminster, CA

- – Harmony SoCal Insurance Services

Affordable Life Insurance Plans Westminster, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

The quote is based on the money worth amount, the expense of insurance coverage, and various other elements. Evaluation it carefully. You could need to pay even more in costs to keep the policy essentially until the maturity day. The majority of global life policies make an assured minimum rate of interest price on the cash money value.

These kinds of life insurance coverage provide just certain insurance coverages: pays the balance of a funding if you die prior to the loan is repaid. If you currently have life insurance policy, you may not require credit life. Rather, you can appoint a few of the survivor benefit to the lending institution to pay the finance balance.

Life Insurance Term Plan Westminster, CA

A benefit of this insurance policy is that it secures funeral costs at current costs. Funeral insurance can be costly contrasted to other types of life insurance coverage. The amount you pay in costs might finish up being even more than what the policy pays when you pass away. And numerous policies will not pay the full cost of the funeral if you pass away before paying a required quantity.

Some of the most typical bikers are: includes term life protection to an irreversible life plan. If you need $500,000 worth of complete insurance coverage, you can buy a $100,000 whole-life policy with a $400,000 term life motorcyclist.

Health Insurance Plans Near Me Westminster, CA

There are some limitations. covers the premium if you satisfy the plan's definition of handicapped. This motorcyclist is normally just readily available to individuals more youthful than 60. pre-pays some or all of the fatality advantage while you're still living. You must have an incurable disease, specified illness, or lasting care ailment.

Generally, this cyclist incorporates 2 plans right into one. Insurance coverage normally lasts till the youngster turns 21 or 25. Some employers and various other groups use life insurance as a perk.

Estate Planning With Life Insurance Westminster, CA

A lot of group life insurance coverage is term life, yet some teams supply irreversible life policies. The quantity of protection is usually limited. A standard group policy with your job normally has a death benefit equal to a couple of times your annual salary. Other team plans cap the survivor benefit at a collection quantity, such as $100,000 for a term life plan and $50,000 for irreversible life.

If you obtain life insurance policy through your company, protection usually ends when you leave your work. Companies usually pay the survivor benefit as a solitary round figure, however there are other choices. Either you or your beneficiary picks how the survivor benefit will be paid. Common alternatives consist of: The insurance provider maintains the survivor benefit and pays the passion to your recipient at normal periods.

During the first two years of a plan, companies normally will not pay the death benefit if the cause of death is self-destruction. If the business doesn't pay the benefit, it needs to return the costs to your recipient.

Your policy will certainly have a brand-new contestable period if it expires and you later on reinstate it. A lot of plans have a 31-day grace duration after your premium's due day. You might pay the costs throughout the moratorium without rate of interest charged and still have protection. If you pass away during this period, your beneficiary obtains the death benefit minus the costs owed.

Health Insurance Plans Company Westminster, CA

You can normally restore a lapsed policy. The majority of firms will reinstate a policy within a five-year duration.

Speak with your representative about the coverages and amounts you require. Consider how much you'll require to assist your dependents after your fatality. Your company needs to tell you exactly how much your plan will certainly set you back. If you're not OK with the cost, ask the company if they have a various policy.

Throughout this moment, you might terminate the policy for any type of reason and get a complete refund. Utilize this moment to ensure the coverage is appropriate for you. Representatives usually utilize graphes to demonstrate how a plan's cash worth may expand. These are usually forecasts and aren't a promise of a policy's efficiency.

Agents can not use you a gift or a price cut on an investment or financing to encourage you to buy life insurance policy. You ought to evaluate your life insurance coverage policy every few years to make certain it still fulfills your requirements.

Best Individual Health Insurance Plans Westminster, CA

The law takes into consideration a death advantage to be repayment for a beneficiary's loss, and not revenue. Beneficiaries hardly ever pay earnings or inheritance tax obligations on a life insurance policy survivor benefit. If you don't name a beneficiary, or your recipient is dead, the company will certainly pay the death benefit to your estate.

A policy's cash worth and death advantage are normally exempt from: creditors. needs in personal bankruptcy process. attachment, garnishment, or other legal procedures. Sometimes you might require to offer your life insurance policy plan to obtain cash. A life insurance coverage plan is individual building. You can sell it simply as you would certainly your various other residential property, however there are special guidelines.

Health Insurance Plans Company Westminster, CA

You don't have to pay tax obligations on earnings from a life settlement. You additionally could want to market your plan if you outlast your retired life financial savings and require to pay living expenses.

For a listing of registered life settlement service providers and brokers, call our Consumer Customer service at 800-252-3439. If your policy has a money worth, you can withdraw from it or cash your plan in. When you pay a plan in, you terminate it and obtain the cash built up in the cash money value.

If you don't repay the funding, it will certainly decrease the quantity of the survivor benefit. A plan with a sped up fatality advantage will prepay all or a few of the survivor benefit prior to you die. You should have a terminal health problem, specified illness, or lasting care illness.

Family Health Insurance Plan Westminster, CA

You may additionally take into consideration life insurance policy as a viable strategy to leave a philanthropic heritage for a cause you sustain. This part of the process can be intimidating for lots of people, however it need not be. Take a fast photo of your finances and answer the following three essential inquiries: 1.

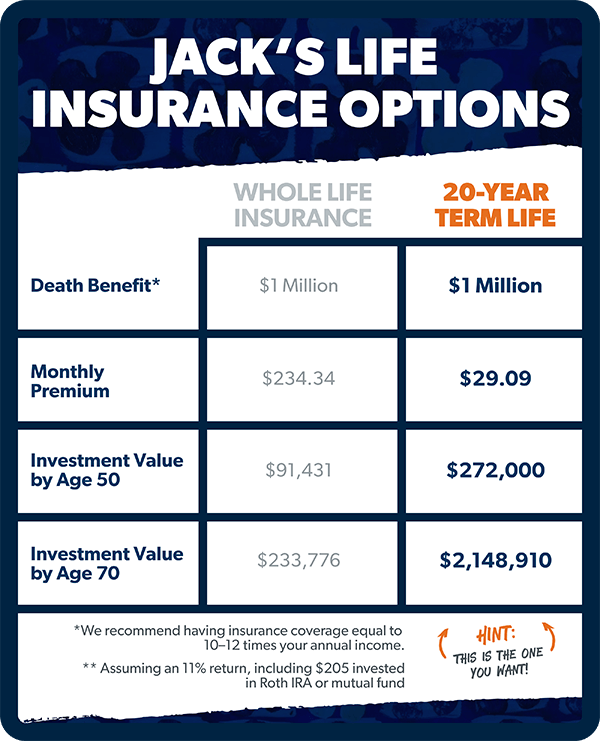

Each of these comes with basic differences. Take into consideration just how these distinctions might benefit you. Term life plans offer settlement of a defined survivor benefit for a particular regard to your life, such as five, ten, 15, or 20 years. Term life insurance policy coverage for most people tends to involve lower costs; nonetheless, the longer the term, the much more expensive your costs may be.

It may be more cost-effective to pay each year as typically there might be a fairly huge added fee for paying in installments. Decided what works ideal for you - Family Plan Health Insurance Westminster. As soon as the plan is purchased, inform your beneficiaries which company issued it, where to discover the paper duplicate of the policy, and any specifics concerning what you want them to do with the survivor benefit

Health Insurance Plans For Family Westminster, CA

These funds can aid your liked ones pay living costs, remain in their home and repay debts, consisting of last costs. It can likewise aid send out a kid to college or leave a tradition.

SCI is not associated with MetLife, and the solutions offered by Self-respect Memorial members are separate and apart from the insurance policy given by MetLife. Preparation services, expert aid, and bereavement travel services are offered to anyone no matter of association with MetLife.

Family Plan Life Insurance Westminster, CA

Solutions are not available in all jurisdictions and are subject to regulatory approval. Not offered on all plan forms. Included with Supplemental Life Insurance Policy.

Exceptional car loan quantities do not participate in the rate of interest credited to the interest-bearing account and can have an irreversible effect on certificate worths and benefits. Upon surrender, lapse, or situation termination, including those scenarios where discontinuation of the team contract leads to termination of specific certificates/policies, financings come to be withdrawals and might come to be taxable to the certificate owner.

It's essential to look at all elements when examining the general competitiveness of prices and the worth of life insurance policy coverage. 14 Previous to the reliable day, the employee will certainly be able to decide out of vehicle signed up coverage.

Health Insurance Plans Individuals Westminster, CA

Nothing in these materials is intended to be advice for a particular circumstance or individual. Please seek advice from your very own advisors for such suggestions. Like a lot of team life insurance policy policies, insurance coverage provided by MetLife contain specific exclusions, exemptions, waiting periods, reductions, limitations, and terms for keeping them effective.

This policy layout is for the customer who needs life insurance policy yet want to have the capability to select exactly how their money worth is spent. Variable plans are financed by National Life and dispersed by Equity Providers, Inc., Registered Broker/Dealer Associate of National Life Insurance Company, One National Life Drive, Montpelier, Vermont 05604.

Insurance policy plans and/or associated cyclists and functions may not be offered in all states. Car loans and withdrawals will certainly minimize the fatality advantage, money surrender worth, and might trigger the plan to lapse.

Aspire is supplied through life insurance policy plans with the John Hancock Vigor Program. Products or solutions provided under the Vitality Program are not insurance policy and go through alter. There might be additional expenses related to these items or solutions and there are extra demands related to engagement in the program.

Best Health Insurance Plans Near Me Westminster, CA

Lesser quantities are available in increments of $10,000. Under this strategy, the chosen protection takes effect two years after registration as long as costs are paid throughout the two-year duration.

SGLI protection is automatic for most energetic obligation Servicemembers, Ready Book and National Guard members set up to do at least 12 durations of inactive training per year, participants of the Commissioned Corps of the National Oceanic and Atmospheric Management and the Public Health and wellness Service, cadets and midshipmen of the U.S.

Estate Planning Life Insurance Westminster, CA

VMLI is available to Offered who professionals that Specially Adapted Particularly Grant Real EstateSAH), have title to the home, and have a mortgage on the home. All Servicemembers with permanent protection ought to make use of the SGLI Online Enrollment System (SOES) to designate beneficiaries, or minimize, decline or restore SGLI protection.

Participants with part-time insurance coverage or do not have access to SOES ought to use SGLV 8286 to make adjustments to SGLI. Total and file form SGLV 8714 or make an application for VGLI online. All Servicemembers ought to make use of SOES to decrease, reduce, or restore FSGLI protection. To accessibility SOES, most likely to . Participants who do not have access to SOES should use SGLV 8286A to to make modifications to FSGLI coverage.

The Federal Government developed the Federal Employees' Group Life Insurance (FEGLI) Program on August 29, 1954. It is the largest group life insurance policy program on the planet, covering over 4 million Federal staff members and senior citizens, along with many of their member of the family. Many workers are qualified for FEGLI insurance coverage.

Children's Life Insurance Plans Westminster, CA

It does not build up any money worth or paid-up worth. It contains Basic life insurance policy coverage and 3 alternatives. If you are a brand-new Federal staff member, you are immediately covered by Fundamental life insurance coverage and your payroll workplace subtracts costs from your income unless you forgo the insurance coverage.

You should have Fundamental insurance policy in order to choose any one of the options. Unlike Standard, registration in Optional insurance is not automatic-- you should act to choose the choices. The expense of Standard insurance coverage is shared in between you and the Federal government. You pay 2/3 of the overall price and the Government pays 1/3.

You pay the full expense of Optional insurance coverage, and the price depends on your age. The Workplace of Federal Worker' Group Life Insurance (OFEGLI), which is a personal entity that has an agreement with the Federal Government, processes and pays cases under the FEGLI Program.

Health Insurance Plans Company Westminster, CA

For J.D. Power 2024 award details, browse through Irreversible life insurance creates cash worth that can be borrowed. Policy car loans build up passion and unpaid policy fundings and passion will reduce the fatality benefit and money value of the plan. The quantity of money value readily available will usually depend on the sort of permanent policy acquisition, the quantity of insurance coverage purchase, the length of time the plan has been in force and any kind of impressive policy finances.

A full declaration of protection is found just in the plan. Insurance policies and/or linked cyclists and functions may not be offered in all states, and policy terms and conditions might vary by state.

Normally, the more youthful and healthier you are, the much more cost effective your life insurance coverage can be beginning at simply $32 per month via eFinancial. With Progressive Life Insurance Firm, protection alternatives range from $50,000 to $1 million.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

Have added concerns? Progressive Responses is your source for all things insurance coverage. See all our life insurance policy tips and resources.

Planning Life Insurance Westminster, CABlue Cross Blue Shield Health Insurance Plans Westminster, CA

Health Insurance Plans Individuals Westminster, CA

Near You Seo Agencies Westminster, CA

Find A Good Local Seo Marketing Agency Westminster, CA

Family Plan Health Insurance Westminster, CA

Harmony SoCal Insurance Services

Table of Contents

- – Affordable Life Insurance Plans Westminster, CA

- – Harmony SoCal Insurance Services

- – Life Insurance Term Plan Westminster, CA

- – Health Insurance Plans Near Me Westminster, CA

- – Estate Planning With Life Insurance Westminst...

- – Health Insurance Plans Company Westminster, CA

- – Best Individual Health Insurance Plans Westm...

- – Health Insurance Plans Company Westminster, CA

- – Family Health Insurance Plan Westminster, CA

- – Health Insurance Plans For Family Westminste...

- – Family Plan Life Insurance Westminster, CA

- – Health Insurance Plans Individuals Westminst...

- – Best Health Insurance Plans Near Me Westmins...

- – Estate Planning Life Insurance Westminster, CA

- – Children's Life Insurance Plans Westminster, CA

- – Health Insurance Plans Company Westminster, CA

- – Harmony SoCal Insurance Services

Latest Posts

Plumbing Emergency Service Near Me Rancho Santa Fe

Local Plumbers Miramar

Costa Mesa Family Portraits Photography

More

Latest Posts

Plumbing Emergency Service Near Me Rancho Santa Fe

Local Plumbers Miramar

Costa Mesa Family Portraits Photography